DIY Real Estate Investing: Lessons From a Future Radiologist

Have you ever played the old version of the board game Monopoly? If so, you’ve had some experience in real estate investing. It’s a strategy game that involves buying and selling properties. After you purchase all the lots on a block, you can buy houses and then a hotel. The rent you can charge soars with the number of buildings owned. Making the wrong moves can result in bankruptcy. Just like in real life, there are risks involved and real estate investing is not for everyone, or even for most people.

It has been widely written that 90% of the world’s millionaires earned their millions through real estate investing. You might assume that you need to be rich to even get in the game. Or that people who own apartment buildings or other large real estate investments must be able to do so because they were born into money, or they had lucrative jobs that gave them tons of money upfront to build a real estate empire. This is true for some, but most of these people started small and used the power of leverage to purchase larger and larger investments to grow their portfolio.

I’m a PGY1, soon to be radiology resident. I definitely wasn’t born rich, nor did I win the lottery or in any other way acquire a windfall of cash. Yet, I have made money in real estate. Disclaimer: I haven’t made $1M (yet).

Story of a billionaire

Real estate has also created many billionaires. Becoming a billionaire takes a lot of luck. I am in no way suggesting that you should expect to become a billionaire by investing in real estate. I do, however, want to highlight one of the investors on the billionaire list and explain one of the principles that allowed him to start small and grow his portfolio to a multibillion dollar value.

His name is Leonard Stern and his net worth is four and a half billion dollars. He began his career working at his father’s pet supply company. But his billion-dollar empire began with a single investment, a warehouse in New Jersey, which eventually led to a portfolio of 260 properties.

I can’t tell you how to become a billionaire. If I knew the secret to doing so I probably wouldn’t give it away for free. However, I can show you how to take a single investment like Leonard Stern did, and turn it into a large real estate portfolio.

So, if you want to learn:

- How using leverage in real estate can lead to large returns, and

- How it allows you to get started in the real estate investing world with little upfront money

AND you want to live vicariously through my personal experience as a real estate investor, READ ON!!!

What is leverage?

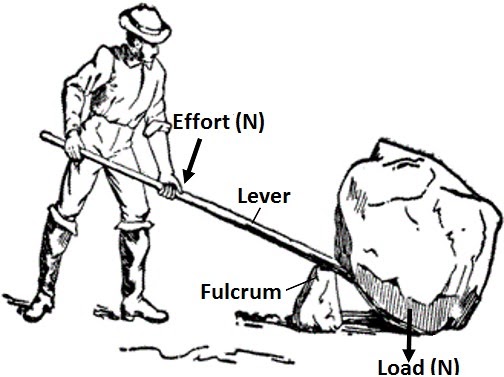

Leverage, quite simply, is the advantage gained by the use of a lever. Imagine a big rock. You ram a crowbar underneath it, push down on the bar and the rock begins to rise. You now have leverage.

Or, in the case of real estate investing, the lever is debt (borrowed capital) that is used to invest in a property. The aim is to multiply the potential returns. At the same time, leverage will also multiply the potential risk in case the investment does not pan out (think of the record foreclosure rate in 2010). When you hear about real estate that is “highly leveraged,” it means that the amount of debt (i.e., mortgage) is higher than the value of the property.

Leverage with a mortgage

There are various ways you can apply leverage in real estate investing. One is through a mortgage. If you are not paying for the property with cash, you need to use a loan to purchase the property. This loan is your first form of leverage. Typically, to purchase any investment property, a bank will require a 20% down payment. You put 20% down, and you own a home that is worth one hundred percent of the purchase price. That assumes you didn’t overpay for the property.

If you purchase a $100,000 rental property, you would have to pay $20,000 as a down payment and then pay closing costs. Closing costs typically are between 2% and 5% percent of the loan value. For this example, let’s say your closing costs were $4,000. This would be 5% of the $80,000 loan you would have to take out after the down payment. You would have to pay $24,000 total and you would own a home worth $100,000.

Let’s say you took out a thirty-year mortgage. Even if the value of the home did not increase (or decrease) at all over that 30 years, if you covered your expenses with rental income, you now own something worth $100,000. You only had to pay $24,000 for it. Buying something worth more than the money you have to put up for it is the most basic form of using leverage in real estate.

| Purchase price | $100,000 |

| Twenty percent down payment | $20,000 |

| Closing cost (five percent) | $4,000 |

| Total upfront costs | $24,000 |

| Initial equity in home | $20,000 |

| Equity after thirty years of payments | $100,000 |

Leverage by using equity in one property to buy another

The second form of leverage doesn’t take the entire length of your fifteen-year or thirty-year mortgage to be fully realized. However, this example will also assume that your property does not increase in value during the entire time you are paying off your mortgage. As you pay off your mortgage every month using rental income, you are increasing your equity in the home. Over time your loan will continue to shrink and you will have more equity.

If your home is worth $100,000, and you start with a 20% down payment, you have $20,000 of equity in your home. This is because you still owe the bank $80,000. Once you pay off $20,000 from your loan, you will have $40,000 of equity. You can sell your home and take that $40,000, minus the cost of paying the realtor who sold your home, and use the money to invest in another property. A typical realtor commission is 6% of the sale price (although you can often negotiate a lower rate).

In this example you’ll have $34,000 to invest in your next property. You can use this to buy a more expensive second property, or you can use it to buy multiple properties. A more expensive property can increase your cash flow every month by bringing in more rental income. If your monthly rental income exceeds your monthly expenses, then you will have a positive cash flow. Buying multiple properties that have a positive monthly cash flow will yield significant extra monthly income.

Leverage can help you increase the overall value of properties you own and increase monthly cash flow. This can be used to supplement your clinical income and provide income in retirement.

Beware the tax person

Typically, the capital gains you make on the sale of a property are subject to tax. If you owned the property for more than one year, it would be taxed at a long term capital gains rate.

The long-term capital gains rates (in 2020) for a single filer are:

| Capital gains tax rates | Income ($) |

| 0% | 0-40,000 |

| 15% | 40,001-441,450 |

| 20% | 441,451 and up |

As a practicing radiologist, your rate would likely be between 15% and 20%. In the example above, with a net gain of $14,000, you would pay either $2,100 or $2,800 in tax. However, if you roll this money into another real estate investment, you do not have to pay taxes on the gains. This occurs through something called a 1031 exchange.

| Selling Price | $100,000 |

| Realtor’s commission (six percent) | $6,000 |

| Money received after commission paid | $94,000 |

| Remaining loan balance | $60,000 |

| Remaining money received after paying off loan | $34,000 |

| Original investment | $20,000 |

| Net profit | $14,000 |

| Money subject to capital gains tax if not used for 1031 exchange | $14,000 |

| Capital gains at 15% tax rate | $2,100 |

| Capital gains at 20% tax rate | $2,800 |

Leverage with a home equity loan

If you do not want to sell this property, but want to leverage it to buy a second property, you can do that through a home equity loan. This is where leverage can really be used to turn your initial investment into more and more properties. You will have to pay this money back as a loan with interest, but you do not need to pay taxes when you receive the money. If you can cover the expense of the extra loan payment through your rentals you won’t have to come up with more out of pocket money.

A home equity loan allows you to get a loan from a bank using the equity in your house. A bank will typically allow you to borrow 80% of the equity you have in your home. If, like the last example, you have $40,000 of equity in your rental property, you could borrow $32,000. Now instead of having your original $20,000 to use as a down payment, you have $32,000. You will have to pay between 2% to 5% of this loan upfront as a closing cost. At the high end of the range for this example, it would only cost you $2,000 to take out the loan.

This allows you to keep the first property, and buy another, without requiring new money except for that needed to pay the closing costs. When you build up equity in this second home, you can repeat the process and have more money to put into other properties. Doing it this way, your original $20,000 down payment can be used to buy multiple properties. If you keep at it for many years, you can turn this first down payment into a large real estate portfolio.

| Value of home | $100,000 |

| Remaining loan Balance | $60,000 |

| Equity in home | $40,000 |

| Eighty percent of equity | $32,000 |

| Closing cost of home equity loan (five percent | $2,000 |

My story

All of the scenarios described so far have assumed that your property has not increased in value. If your property does increase in value, leverage becomes even more powerful.

For example, five years ago, I purchased a townhouse for $80,000. I rented it out, had all expenses covered by the rent, and was collecting $250/month on top of expenses. Just recently, two of the townhouses in the development sold for $140,000. I owe $63,000 on the mortgage. That means that I have $77,000 in equity in the home.

After a 20% down payment and closing costs, I paid about $20,000 for the house. If I sold the house now for the price the neighbors sold theirs for, I would make $77,000. Due to the use of leverage, and a 59% increase in value of the home, my initial investment increased by almost 400%. If I were to borrow $60,000 as a home equity loan to purchase another property that also returns 400% over the next five years, the original $20,000 investment would be worth $240,000 over the course of ten years. That money could be used to buy more properties and continue the returns. This is called making your money work for you.

Q: How can you guarantee that your property will increase in value?

A: You can’t. Some things you control and some you don’t.

Properties can increase in value for reasons that are out of your control: the neighborhood becomes more desirable, the value increases due to time, or the overall real estate market becomes hot. Of course, the opposite could also occur with all three variables, causing the value of your property to decline.

What can you do to increase the value of your property?

Buy the home at a good price

If you pay less than market value, you immediately have extra equity in the house. I experienced this when buying a vacation rental property. The contractor built condos with the hope of selling them for $400,000. He sold a few in 2007. Then the housing market collapsed. I got one for $250,000. When the market recovered, I sold the property for $288,000. If I had purchased the home for $400,000, it would have been a terrible investment.

| Purchase price | $250,000 |

| Down payment (20%) | $50,000 |

| Sale Price | $288,000 |

| Equity in home | $65,000 |

| Remaining loan balance | $185,000 |

| Realtor’s commission (6%) | $17,280 |

| Money received after commission paid | $270,720 |

| Money received after loan paid | $85,720 |

| Net Profit | $35,720 |

Make upgrades to the home

This is another way to leverage your money and add value to your home in a couple of ways. First, it can increase the appraisal value of your house, which will enable you to borrow more money through a home equity loan. Secondly, it will (hopefully) increase the sale price of the house.

Home buyers can be emotional when purchasing a home. Seeing an upgraded kitchen or bathroom can make a house seem much more valuable. The value that a buyer assigns to the house can be much larger than the cost of improvements.

For example, upgrading a kitchen for $5,000 may result in a $10,00 increase in perceived value. This is the reasoning behind flipping houses. Any property owner with the know-how who can wield a hammer and a paint brush can make their own upgrades. Doing so is much cheaper than paying someone else to do it. However, most buyers do not want to have to go through the process of upgrading the home or they may not feel comfortable doing it themselves. Others just prefer a move-in ready house.

Upgrading a home can also enhance an investment when it allows you to increase the rent. If you put $5,000 into a home, allowing you to increase the rent by $200/month, this investment can pay for itself in a little over two years. Also, an upgrade can allow you to borrow more money against your house, and you can cover the payment of the loan with this increase in rent.

If the home equity loan adds $200/month to your monthly payment, but your upgrade increases your rent by $200 or more per month, it can be like borrowing free money to use on other properties. When you sell or borrow against this home, you will have more money to buy other properties.

This seems too good to be true

The higher the potential return, the greater the risk.

If real estate investing is so easy, why doesn’t everybody do it? The returns can be phenomenal, and people can get really rich from real estate investing. It seems like a no-brainer.

Cue the standard investment maxim: “the higher the potential return, the greater the risk.” If any of this was guaranteed, everybody would be doing it. Using leverage can increase your returns, but it can also significantly increase your risk. Owing people money always comes with risk. A decrease in the value of a property that has little equity can be devastating.

For example, if you buy a $100,000 home, make a 20% down payment, and pay closing costs of 5% of the loan value, you will pay $24,000 out of pocket for the home. If the market declines and your home loses 20% of its value, it will be worth $80,000. You owe $80,000 on your loan. If you sold your home, you’d pay a 6% real estate commission. If the selling price was $80,000, this would cost you $4,800. After paying the realtor, you would get $75,200. To pay the $80,000 you owe to the bank, you would have to come up with $4,800.

| Purchase price | $100,000 |

| Down payment (20%) + closing cost (5% of loan value) | $24,000 |

| Sale Price | $80,000 |

| Equity in home | $0 |

| Remaining loan balance | $80,000 |

| Realtor’s commission (6%) | $4,800 |

| Money received after commission paid | $75,200 |

| Extra money needed to pay off loan | $4,800 |

| Net Profit | -$28,800 |

As you can see in this example, leverage works both ways. A 20% decline in the value of your home caused you to lose your entire initial investment plus $4,800.

It’s possible to be overleveraged when you purchase a home. If the home is worth $80,000 and you pay $100,000 for it with debt, you already owe more on the home than it’s worth. The bank tries to avoid this situation by conducting an appraisal of the home and not granting a loan for more than the property is worth. An appraisal is based on the current value of comparable homes, which can change at any time. You can also become overleveraged if you purchase a home with debt and the value of the home plummets one month later.

Going back to my vacation home example, if I purchased the home for $400,000 and it was worth $250,000 one year later, I would owe much more than my original investment. I would have had to put $80,000 dollars down. I would have a loan value of $325,000. If I was only able to sell it for $250,000, I would lose my initial $80,000 investment and would still owe $15,000 to the realtor and $70,000 to the bank.

Rental property (sometimes you eat the bear and sometimes it eats you)

You can get into trouble using leverage (i.e., debt) to invest in a rental property as well as a home that you buy to live in. The goal with rentals is to have the rental income cover your expenses and hopefully provide extra monthly cash flow. Being overly leveraged and not able to make your monthly mortgage payments through your rental income can cause you to lose your property. Even if you don’t lose the property, you might be forced to make payments out of your own bank account. That alone can make it a bad investment. This situation can also pressure you to sell the home at an inopportune time at a significant loss.

Closing remarks

Leverage allows you to get involved with real estate investing with less money than you would anticipate needing. If your investments are successful, that first investment can be leveraged to make another, and then another, and so on, until one day you have a sizable real estate portfolio.

I don’t provide these examples to dissuade you from using leverage to invest in real estate. I think it is a powerful way to grow a real estate portfolio to reach your financial goals. I have used and intend to continue to use leverage to grow my real estate portfolio. I just want to make the point that it is not a get rich quick scheme and there are real risks involved. It requires a great deal of time and effort to make sure you are making good real estate investment decisions. If you choose good properties and have good timing leverage can increase your returns.

Through these examples, I tried to show that leverage allows you to get involved with real estate investing with less money than you would anticipate needing. If your investments are successful, that first investment can be leveraged to make another, and then another, and so on, until one day you have a sizable real estate portfolio.

Finally – good luck! If you have any questions or would like help getting started, feel free to email me at chris.musto2@gmail.com.