Play By the Rules and You Could Love Retirement

Are you thinking about retiring? Unless you’re already retired, I suggest you DO start thinking about it. Whether it’s 5 years down the road or 50 years into the future, it’s wise to start planning early.

Why is that? I could fill beaucoup tomes on that answer, but let’s keep it simple: because getting to the $ number you need in order to retire with the lifestyle you’ve imagined for yourself will only happen if you take action. Starting early will give you more options and increase the likelihood of a happy retirement.

Next question. What do you need to know to prepare for retirement? That, my friends, is the subject of the day. Read on!

Note: I’ll only be discussing the financial aspects of retirement, but it’s also important to think about what you will DO in retirement (e.g., fishing, taking up Muay Thai boxing, learning a new language, starting a new career, riding your bike across the country, joining a dead poet’s society or pie baking club, writing a book…well, I don’t know what your cup of tea is— you fill in the blank). Point is, just remember that the financial part isn’t the only aspect of retirement planning that you would do well to prepare for.

Oh, and as the title suggests, I’ll be talking about rules—specifically, the 4% Rule and the Rule of 72.

In prior posts I talked about retirement plans and investing accounts, which you may want to read now if you haven’t already.

But saving and investing is only one aspect of financially planning for retirement. You also need to think about spending! This post will address both.

Perhaps right now you’re thinking, spending?! As in, should I buy that fancy boat to go with the beach house? Well, that’s not the type of question I can answer for you.

However, I will suggest four helpful questions, and then offer some practical information in response that can help you build a retirement financial plan that’s right for you.

When making a financial retirement plan, you might ask the following:

- How much will I need in annual retirement income?

- What will be my sources of income?

- How big of a nest egg will I need?

- What savings rate and length of time will it take to build that nest egg?

Let’s consider each of these questions in turn.

Question #1: How much will I need in annual retirement income?

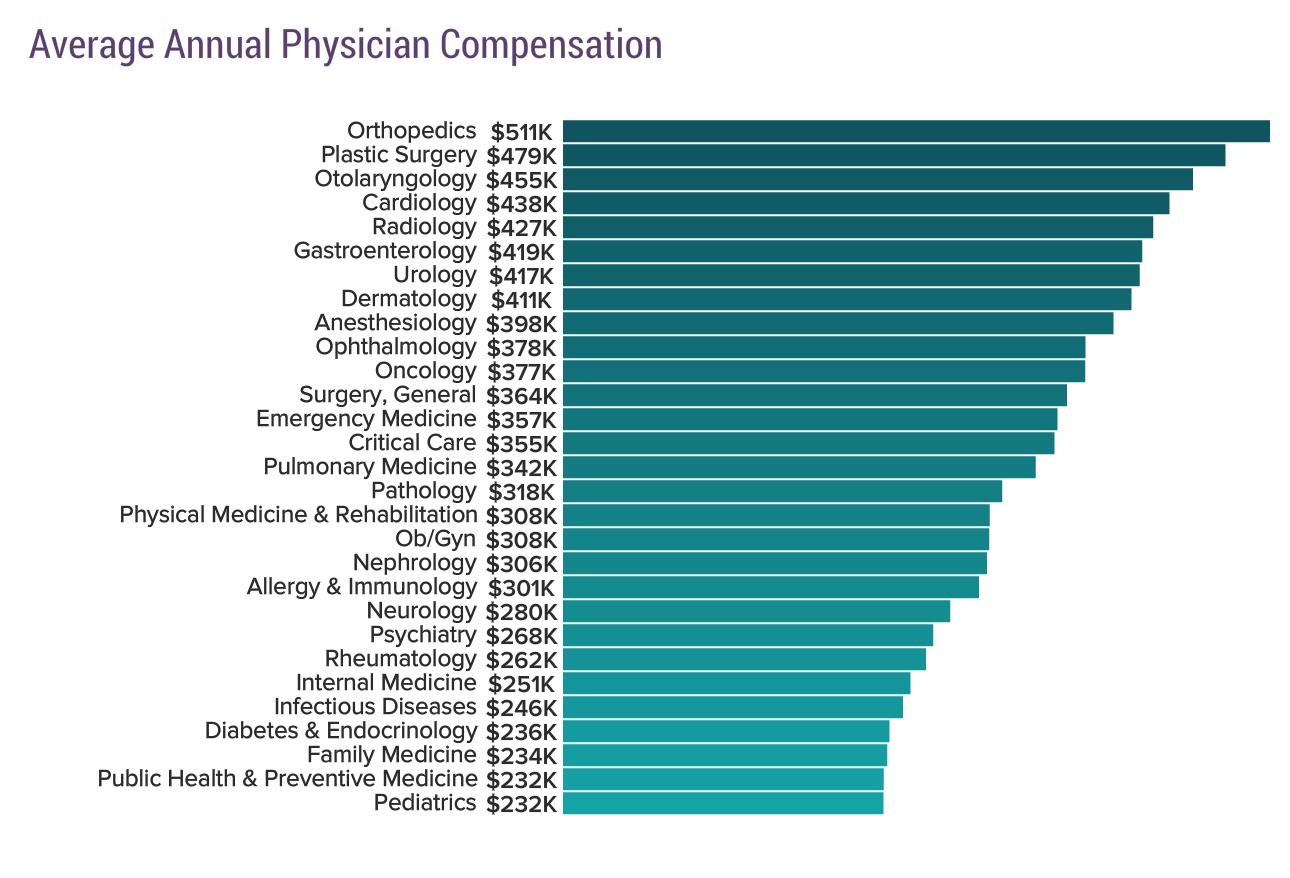

Let’s say you are earning an average radiologist salary of $427,000 (according to the 2020 Medscape survey). Congratulations! You are among the top physician earners!

Of course, it’s quite likely that you earn much more or less than this amount. A radiologist just starting out earns around $250,000 to $350,000 and high-earning private practice radiologists can earn three to four times that amount. With so much variation in salary during your career, what number should you use in order to plan your annual retirement income?

Do your investments/pension/social security/other income sources need to replace all of your earned income in order to retire with the same standard of living as you had during your working years? The answer is no. Financial planners assume you’ll spend about 80% of the income you make before you retire during your retirement—that’s known as your retirement income replacement ratio. Although this may be true for the general population, it probably doesn’t make sense for radiologists and other high-income earners. Why not?

Some expenses will decrease (yay!)

Many of your expenses will decrease. In retirement (assuming you no longer have earned income or that it has decreased considerably), you will no longer be contributing to retirement accounts. Let’s say you’ve been earning $400,000/year and contributing 20% to retirement accounts ($80,000). You won’t be making that contribution when you’re retired.

What else changes in retirement? If your income goes down, your taxes go down. If you have $400,000 of earned income and your effective tax rate is 30% (you can refresh your knowledge of income tax here and here), you will pay $120,000 in income taxes. If your retirement income is $200,000, from investment income and social security, your effective tax rate might be as low as 15-20%, for a tax bill of $35,000 to $40,000. It could even be less than that, depending on the type of investment income and the state in which you live.

Other expenses that may go down in retirement include debt (mortgage, car payment), work-related expenses (clothes, travel), insurance (life, disability), childcare, and college costs. If you downsize to a smaller home, you will save on property taxes, property insurance, and maintenance costs.

Some expenses will go up (uh-oh!)

What costs go up in retirement? If you retire before age 65 and your employer doesn’t extend health insurance during retirement, you will likely pay much more in health insurance premiums and other health care costs until you are eligible for Medicare. Once you sign up for Medicare, your premiums will go down, but they may be higher than what you paid when you were employed.

Medicare premiums go up as your income increases. The standard Part B premium amount in 2020 is $144.60. But if your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you’ll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium. For example, if your yearly income in 2018 was above $174,000 up to $218,000 (married filing jointly), your premium amount would be $202.40 in 2020. If your yearly income in 2018 was $750,000 and above (married filing jointly), your premium amount would be $491.60 in 2020. Some retired radiologists on Medicare may experience this extreme situation if their spouse is still working and generating a large income.

The $285,000 question

A BIG unknown is long-term care costs. Most radiologists will not buy long-term care insurance, but rather self-insure (i.e., save enough money to pay for the costs). A 65-year-old couple retiring in 2019 can expect to spend $285,000 in healthcare and medical expenses throughout retirement. This doesn’t include the additional annual cost of long-term care, which, in 2019, averaged from $19,500 for adult day care services to $102,204 for a private room in a nursing home.

You may choose to travel more in retirement, so those costs can go up considerably. Or you may buy a second home. Or start paying someone else to clean your home, shovel your snow, do your yard work, and prepare your taxes. Or you may decide to stop paying someone and do all those things yourself once you are no longer working.

So, how do you figure out what income YOU will need in retirement? To reach the most accurate number, don’t base it on a percentage of your income. Rather, look at your current expenses (yes, that might take some effort if you don’t have a handle on this already), and make adjustments based on how you think you will live in retirement. If you’re 30 years away from retirement, it will be harder to guestimate what you will need. In that case, start out with a reasonable number, say 20-50% of current income, and make adjustments over the years. You need SOME goal to shoot for in order to plan how to get there.

Question #2: What will be my sources of income?

Let’s say your magic number (the amount you need each year in retirement) is $150,000. Where will it come from?

Some possibilities:

- Social security

- Pension

- Investment income

- Annuities

- Inheritance

- Lottery

Most radiologists can count on social security and investment income. Fewer will also draw from other types of investments or pensions. Annuities allow you to basically buy a pension, and although it may make a lot of sense to purchase single premium immediate annuities, not many people do. It probably isn’t wise to count on an inheritance, and foolish to rely on winning the lottery.

Social security

A discussion of social security is way beyond the scope of this post, but basically, if you’ve paid into the Social Security system for at least 10 years you become eligible for early retirement benefits at age 62. However, you will receive a higher monthly benefit if you wait until your “full retirement age”—66 for people born in 1954, then add two months for each year until reaching 1960, at which point 67 becomes the new full retirement age for all—and an even higher one if you wait as late as age 70, at which point the benefit maxes out. Spouses can also claim benefits, based on either their own earnings record or their spouse’s.

The maximum social security benefit for someone who retires in 2021 is $3,895/month ($46,740/year). The average retired worker receives $1,512.63/month ($18,151/year), as of May 2020. The amount you can expect to receive will depend on the number of years you contributed, the amount you contributed, the age at which you start to collect social security, and whether you’re collecting based on your history or that of your spouse.

Pension

49% of the workforce in private industry has no private pension coverage. If you’re lucky enough to work at an academic center (okay, I’m biased because I’ve spent my whole career in academic radiology), you will probably receive a pension from the university. The amount will depend on your years of service and salary level near retirement. Note: this refers to the salary from the university and does not include practice plan income, which is usually the majority of a radiologist’s income. Radiologists who work for the VA and meet service requirements receive a generous pension. The majority of radiologists, however, are in private practice and do not receive a traditional pension.

Investment income

This refers to retirement accounts, taxable brokerage accounts, certificates of deposit, and savings accounts. It may also include real estate or other sources of investment income. All together, you can consider this your investment portfolio. During retirement, those investments can grow (from dividends and interest) and they can decrease (from market losses and spending).

Question #3: How big of a nest egg will I need?

Let’s say you’ve estimated needing $150,000/year in retirement income. How much investment income will you need? Since you can estimate what your social security income will be (or ignore that income if you don’t trust the government), and any pension income, your investment income must be enough to make up the shortfall.

There are different ways to determine how much money you need to save to get the retirement income you want. The 4% rule can be used to determine how much you need to save as well as how much you can spend.

To determine how much you can spend: add up all of your investments, and withdraw 4% of that total during your first year of retirement. In subsequent years, you adjust the dollar amount you withdraw to account for inflation.

Using the 4% rule to determine how much money you need to save, you divide your desired annual retirement income by 4%. To generate $150,000, for example, you would need a nest egg at retirement of about $3,750,000 ($150,000 ÷ 0.04). This strategy assumes a 5% return on investments (after taxes and inflation), no additional retirement income (e.g., Social Security), and a lifestyle similar to the one you would be living at the time you retire.

Note: hot off the press – the 4% rule is now the 5% rule! Even so, I’m still using 4% in my calculations to stay on the conservative side. Also, many people feel that a 4% withdrawal rate is too high and recommend a 2-3% withdrawal rate, depending on individual circumstances. A discussion of a safe withdrawal rate (SWR) is beyond the scope of this post, but the bottom line is this – If you want an SWR of 4%, you need to save more than if you want an SWR of 3%. The 4% rule also assumes 30 years of retirement – an early retirement will require a bigger nest egg or a smaller SWR.

Is it reasonable to expect a 5% real return? The historical average annual return (1926 to 2018) for stocks is 10.1%. Note: that’s 100% stocks, and you probably have bonds and other types of investments in your portfolio, not just stocks. That 10.1% also doesn’t account for taxes or inflation. Over the last 100 years, inflation has averaged 3%. However, during the past 10 years, inflation has been well under 3% each year except one. The current inflation rate is only 1.4%. In 1980 it was 13.5%.

Let’s assume an inflation rate of 3% going forward. That brings the return on 100% stocks down to 7.1%. Are you paying 1% to your financial advisor? If so, your return is now 6.1%.

Let’s say you’re invested in 50% stocks and 50% bonds (not unreasonable for people close to or in retirement). The historical average annual return (1926 to 2019) for this portfolio is 8.2%. Knock off 3% for inflation and assume you pay negligible investment expenses or taxes, and you’re close to a 5% return.

Question #4: What savings rate and length of time will it take to build that nest egg?

Assuming you need a nest egg of $3,750,000 as calculated above, what amount do you need to save per year, and for how many years do you need to save to build that nest egg? This is actually more complicated than it may seem since you probably won’t save the same amount every year for 30 years.

You can reasonably expect your income to increase over your working years (although it may not increase every year, and in some years it may decrease). Historically, average radiologist salaries have increased most years.

Your salary will be lowest early in your career, when you might also have many competing expenses. The amount you can save for retirement will increase as your salary increases and your expenses decrease. So, why not wait several years to start saving?

The answer is that the earlier you start to save, the longer your money has a chance to grow.

Rule of 72: Divide the interest rate into 72, and the result is the number of years it takes your money to double.

This brings me to the Rule of 72, which is a way to determine how fast your money will grow at a given interest rate:

Divide the interest rate into 72, and the result is the number of years it takes your money to double.

So, if your investment earned 7.2%, your money would double every 10 years (72 divided by 7.2 equals 10). If you assume a return of 5%, your money would double every 14.4 years. Note: the percentage return you assume is AFTER inflation, expenses, and taxes.

Think about that. $25,000 at 5% would double to $50,000, then double to $100,000, then double to $200,000 in 43.2 years. If you invest that money at age 32, you’d have $200K at age 75. If you invest that amount at age 46, you’d only have $100,000 at age 75 (two doublings).

Of course, a radiologist doesn’t invest for one year and call it quits. Ideally, she invests every year of her working career. You can use a future value calculator or the future value function of a spreadsheet to determine how much money a yearly investment will compound over a given length of time, assuming a certain percentage of return.

Let’s go back to the $3,750,000 nest egg. If you invest 15% of a $400,000 annual income ($60,000/year) for 30 years, and assume a 5% real return, you would generate $4,077,425. That’s pretty close to your nest egg goal! But most radiologists should easily be able to save more than 15% of their income. Let’s say you invest 25% ($100,00/year) and assume a return of 5%. You would generate $3,938,354 in just 22 years. If you start investing at age 32, you’d reach that goal at age 54 – early retirement!

You can play with the numbers (it’s kind of fun), changing the amount you invest, to see what it would take to shorten or lengthen the time to retirement. One note of caution: increasing the return rate will add a greater element of uncertainty and the higher you make it, the more likely your calculation will be an exercise in optimism/fantasy and not reality.

Recap (not a question)

You can play with an infinite number of variables to determine how much money you will need in retirement. If you want to keep it simple, especially when you are young and don’t have a clear vision of your retirement lifestyle, you can guestimate an annual retirement income to be 20% – 50% of current income, and using the rule of 4%, divide that annual income by 4% to determine the size of your nest egg.

To estimate how long you need to save in order to retire at a desired age, use the rule of 72 (with the aid of a future value calculator or the future value function of a spreadsheet). When you do retire (congratulations!), you can use the 4% rule again to estimate a safe withdrawal rate (SWR). I would suggest, however, that you use the 4% spending rule only as a guide, and incorporate plenty of flexibility in your withdrawal strategy. When your portfolio is doing well, spend a little more. When it’s not doing well, spend a little less. The more flexible you are with spending (and I’m a big fan of low fixed expenses for this reason), the more likely you will enjoy a long and financially successful retirement. And bring your retirement vision to fruition, whatever that may look like to you (fancy boat and beach house sold separately).