The Finance Savvy Resident: Your Future-Self Will Thank You For This

Or your future-self might not; I don’t know, because I can’t predict the future. But I can offer some solid, evidence-supported suggestions—apropos to residents—as to potentially prescient, if not generally, sensible financial moves. Whatever your particular path or current circumstances, it is never too early nor too late to consider your financial future; how you can help position yourself for financial stability and mitigate financial disaster. Of course, as you might’ve guessed, such things are not one-size-fits all. Much like ice cream, radiology residents come in as many flavors as exist under the sun. I’m waxing a bit poetic here, because now we are about to get into some serious stats and figures! Ready?

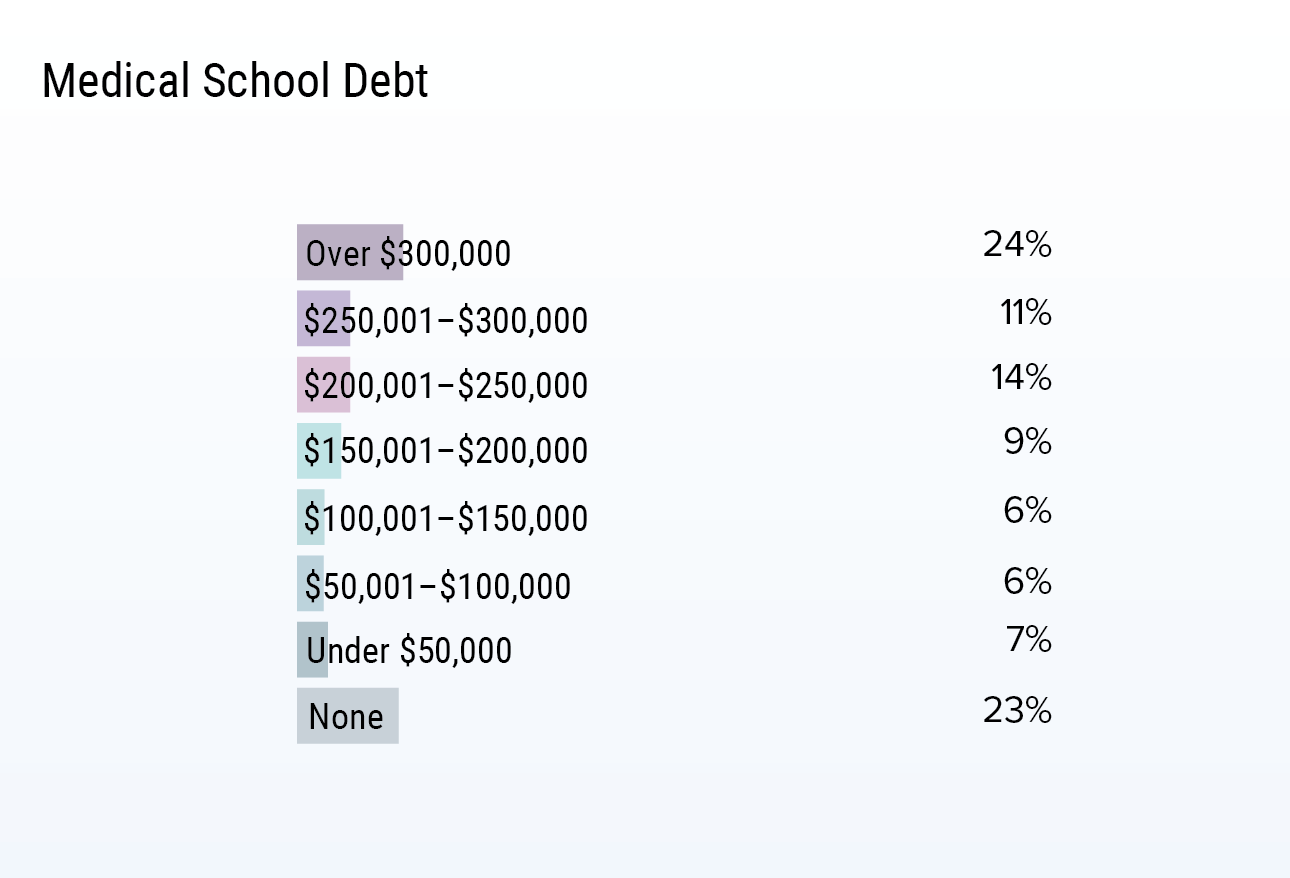

Residents are a heterogeneous group. They may be married with kids, married without kids, single, or part of a blended family. Their student loan debt ranges from nothing, to average ($200,000), to over $300,000. These amounts can be doubled in dual-physician households and some monster debts reach over $1,000,000. Another 19.3% have additional consumer debt (Median amount $12,000).

Medscape Residents Salary & Debt Report 2020

Total Premedical and Medical School Debt (%)

No debt ($0) 26.7

$1 to $49,999 5.6

$50,000 to $99,999 6.1

$100,000 to $149,999 9.1

$150,000 to $199,999 13.1

$200,000 to $299,999 26.2

$300,000 to $399,999 10.5

$400,000 to $499,999 2.0

$500,000 or more 0.8

Median education debt of those reporting education debt $200,000

AAMC Medical School Graduation Questionnaire (July 2019)

Residents may be married to someone without earned income or someone with a high income, or have other financial resources (inheritance, previous work savings, etc.).

Duration of residency ranges from 3 to 7 years (radiology is 5 years followed by fellowship). Not every radiology resident follows a typical pathway to graduation.

One thing that is pretty uniform among residents is salary. Resident salary averages $62,400 ($64,600 in radiology), and ranges from $57,200 in year 1 to $68,500 in years 6-8.

The point of all this is that although general advice works for most residents, you will have to make decisions based on your individual circumstances. Having said that, here are some of the most important financial considerations that residents should be aware of:

Disability insurance (DI)

A professional has a greater statistical probability of suffering a severe disability that impedes their ability to work than of dying prematurely. More than one in four 20-year-olds will experience a disability for 90 days or more before they reach age 67. If you become too ill or injured to work before you reach peak earning potential, you’ll still have to pay back the lender that bankrolled your medical school education. The lender will not care that you are disabled. When should you get DI? If you have a pre-existing medical condition you might want to wait until you are a resident. About 70% of residents are offered fully paid group disability insurance through their employer that does not require a medical exam or medical history taking (but they may deny anyone who had previously been denied DI). An individual policy is best, but it will cost more (ranging from 1% to 3% of your annual income per year) compared with the cost of a group policy .

Life insurance

If someone depends on you financially, life insurance provides for them if you die. Some residents with children choose to purchase life insurance during residency (or before) and others wait until they finish training, when they can more easily afford the premiums. Those who wait are gambling with their spouse’s and children’s financial future. Other good reasons to purchase life insurance early are that you will pay lower premiums (as you will be younger at the time of insurance purchase), and you will lock in the insurance rates while you are still healthy. If you wait, and become ill or disabled as a resident, your premiums could rise significantly, and you may even become uninsurable.

Will

If you have kids, you need a will that designates guardians for your children should you and any other custodial parents die. If this occurs and such a designation is not in place, a court will decide who will be the legal guardian. This will most often be a relative who is willing to take on the responsibility, but in extreme cases, the court could mandate that your children become wards of the state. You may not want one or more of your relatives to raise your children, particularly if they don’t share your views, aren’t financially sound, and aren’t genuinely willing to raise children.

Emergency fund

Sh#%! happens. Your kid breaks her arm and you get a big medical bill. The car needs repair (Note: In 2017, the average auto repair bill was between $500 and $600.) Your washing machine dies. An emergency fund provides you with ready cash to cover these expenses so that you don’t have to pay for it with credit (or sell investments in a down market). How much $$$ should be in your emergency fund? Three to six months of essential living expenses is the general recommendation. For many residents, this may mean $15,000 to $30,000. Where should you keep it? This is money that you will need NOW, so it needs to be readily available. Typically, this means keeping it in a savings or money market account. Note: Online accounts pay higher interest rates (~0.5% at the time of this writing) than do brick-and-mortar banks (which pay an average rate of 0.08%). Also note: An emergency fund is for emergencies (duh) and not for a new HDTV.

Loan management

You need a plan for your student loans. The most comprehensive guide is available here for free. (Note: This is an area where it can be very important to consider your personal situation, especially if you’re married to another earner.) Start by consolidating your federal loans so that you’re eligible for Public Service Loan Forgiveness (PSLF) (even if you may not ultimately go this route) and enter into an income driven repayment program. The best choice for most residents is REPAYE (Revised Pay As You Earn). (Note: The goal here is to pay the minimum required qualifying payment each year and to have as much debt forgiven at the end of ten years.) The monthly payments are usually an affordable $0-$300/month so you can avoid deferment or going into forbearance. Next you want to refinance any private loans you have (which are not eligible for PSLF). Private student loans can be refinanced for free and you should consider refinancing whenever you can get a lower rate. Typically, when you finish residency you can get a better rate because of your enhanced income status.

Retirement plan contributions

About half of hospitals offer residents a retirement plan (401k, 403b) and some will match your contribution up to a limit. By not taking advantage of this match you are leaving money on the table, essentially taking a self-imposed pay cut. The other retirement contribution that residents should consider is the Roth IRA (named after Senator William Roth). You pay the taxes on the front end (at the time of contribution), but there are no taxes on the back end (at the time of withdrawal) and money grows tax free while it’s in the account. As a resident, you may be in the lowest tax bracket you’ll ever be in for the rest of your life so it’s a good time to contribute to a Roth IRA because the front end taxes will be low. You can also contribute to a Roth IRA for a non-working spouse from your income. (Note: Anything that has tax ramifications should be considered in terms of your personal circumstances.) If you are pursuing PSLF (and thus want to minimize the amount you pay back along the way), you want to minimize your taxable income in order to minimize your loan payments (which are based on income) by maximizing contributions to a pre-tax retirement plan, like a 401k. Also, if your spouse is a high earner, you may have to contribute to a Roth IRA through the “back door.” Note: You can’t put off contributing to a Roth IRA during residency thinking you will just make bigger contributions after you graduate. This is because you’re only allowed to contribute a certain amount per year ($6,000 in 2021). Also note: Married residents with earned income of $65,000 or less may qualify for a Retirement Savings Contributions Credit (free money from the federal government!) – another reason to contribute to a retirement account.

Pay off high interest debt

What is high-interest debt? I’m not talking about student loans or mortgages. I mean high interest credit card debt. (Note: In December 2020, the median interest rate on credit cards that were assessed interest reached an astronomical 19.4%.) I mean that 6% car loan. I mean that 8% personal loan that paid for that trip to Maui for your cousin’s wedding. Pay those off. Doing so will be the best investment you can make. In these examples, you’re getting a 6%-19.4% guaranteed return on your investment. That’s hard to beat.

Even Uncle Sam advises you to pay off high-interest debt:

“No investment strategy pays off as well as, or with less risk than, eliminating high interest debt. Most credit cards charge high interest rates — as much as 18% or more – if you don’t pay off your balance in full each month. If you owe money on your credit cards, the wisest thing you can do is pay off the balance in full as quickly as possible. Virtually no investment will give you returns to match an 18% interest rate on your credit card. That’s why you’re better off eliminating all credit card debt before investing. Once you’ve paid off your credit cards, you can budget your money and begin to save and invest.”

Final piece of advice: When it comes to finances and life, hope for the best but prepare for the worst.

And remember: Knowledge is power! The Reading Room is always open.