Why Smart Radiologists Can’t Manage Their Money

Once you’ve finished the 26th grade (average stage of a radiologist at the end of training), you should be well-equipped to practice radiology. You’ve survived all the entry requirements, standardized tests, rigorous educational demands, and long and arduous nights on call.

After years of dedication and sacrifice, you have become a valuable member of the healthcare community. Medical school, residency, and fellowship have prepared you well.

If you’ve landed your dream job – congratulations! You managed to impress your employer with your sterling record, professional demeanor, and glowing references. You’re ready to start practicing radiology independently.

There’s no question that by objective standards you are a very smart person. Does this equate to being good at managing money? If you read my prior post, the one where I espouse the need for required financial literacy education, you probably know how I would answer this question. That would be a resounding NO.

If you were lucky enough to receive personal finance education along the way, or you became aware of its importance and started teaching yourself by reading finance books and blogs and listening to finance podcasts, this post might not apply to you. (I say might because not all finance advice is good advice.) To the rest of you, who might not be smart at managing money, I suggest a few reasons why that’s so.

7 Reasons why you’re a smart radiologist but might not be smart at managing money:

- Being smart at one thing doesn’t make you smart at everything. Would you represent yourself in court? No, you’d probably hire a lawyer who has spent years training to be good at lawyering. Unless you’ve been appropriately trained, you wouldn’t fly a plane, install electrical wiring in your home, or repair your car. If you haven’t had any financial education, what makes you think you’d be good at managing money?

- You don’t know what you don’t know. In radiology parlance we say “you only see what you look for.” Case in point: if you don’t know what a pneumothorax looks like on a supine chest radiograph, you won’t see it. The White Coat Investor published a list of doctor’s financial mistakes and there were so many of them that it required four posts. I’ve read several such lists. The same stories of how radiologists and other physicians learned financial lessons from the School of Hard Knocks have been told over and over again. Radiologists don’t intend to make bad financial decisions. They just don’t realize they’re doing so.

- You don’t have time. Radiologists are busy. In the words of Theodore Roosevelt, “nothing in the world is worth having or worth doing unless it means effort, pain, difficulty… I have never in my life envied a human being who led an easy life”. What I’m getting at here is that if you want to be smart about money, you have to invest some time to become educated about managing money (or learn how to get good advice at a fair price).

- You don’t care. By this, I don’t mean you don’t care about making smart financial decisions, but that you don’t have any interest in learning about finance. I wouldn’t expect everyone to be as passionate about it as I am. Maybe you spend your time outside of practicing radiology honing your cello skills, climbing Mount Everest, brewing the perfect beer, performing stand-up comedy, running for political office, playing chess at a master level, or any one of a number of impressive hobbies. My aim is not to judge financial education to be more or less important than any other pursuit, but rather to point out that we’re good at what we care about and value most.

- You’re too trusting. Radiologists are trained to provide service based on the best interests of the patient. It’s natural to think other professionals would practice with a similar ethical conduct. Unfortunately, this isn’t always the case. A radiologist’s lack of financial knowledge creates a void that can be easily filled by unscrupulous investment professionals, realtors, lawyers, and bankers who see radiologists and other high-income professionals as “targets”. Note: I by no means consider all of these professionals to be unscrupulous, but sometimes it’s hard to tell who is and who isn’t. But that’s only part of the problem. Your trusted colleague may have your best interest in mind when, for example, she raves about her financial advisor. As far as she knows, her financial advisor is a nice person who has all the qualifications needed to do a good job managing her money. But what if your colleague, who is an excellent radiologist, doesn’t realize that she’s paying her advisor $20,000/year to do not much more than buy and sell funds that underperform cheaper, more broadly diversified funds? If you don’t have a basic level of financial literacy, you won’t be able to recognize when someone, even when acting in good faith, is not providing good advice. Ironically, by the time you know enough to choose a good financial advisor, you know a lot of what you need to know to manage your finances yourself. One of my favorite mantras: no one will care about your finances as much as you do.

- You think you know more than you do. This refers to those of you who like playing the stock market because it gives you a sense of control. So much of the practice of radiology is outside of a radiologist’s control. Many physicians think they’re absolute geniuses when it comes to playing the market. Because they have a lot of superficial knowledge in investing, they overestimate their ability. In reality, even the smartest, most well-informed investment professionals can’t accurately and consistently time the market. Note: if you’re tempted to try to “pick the winners”, read this.

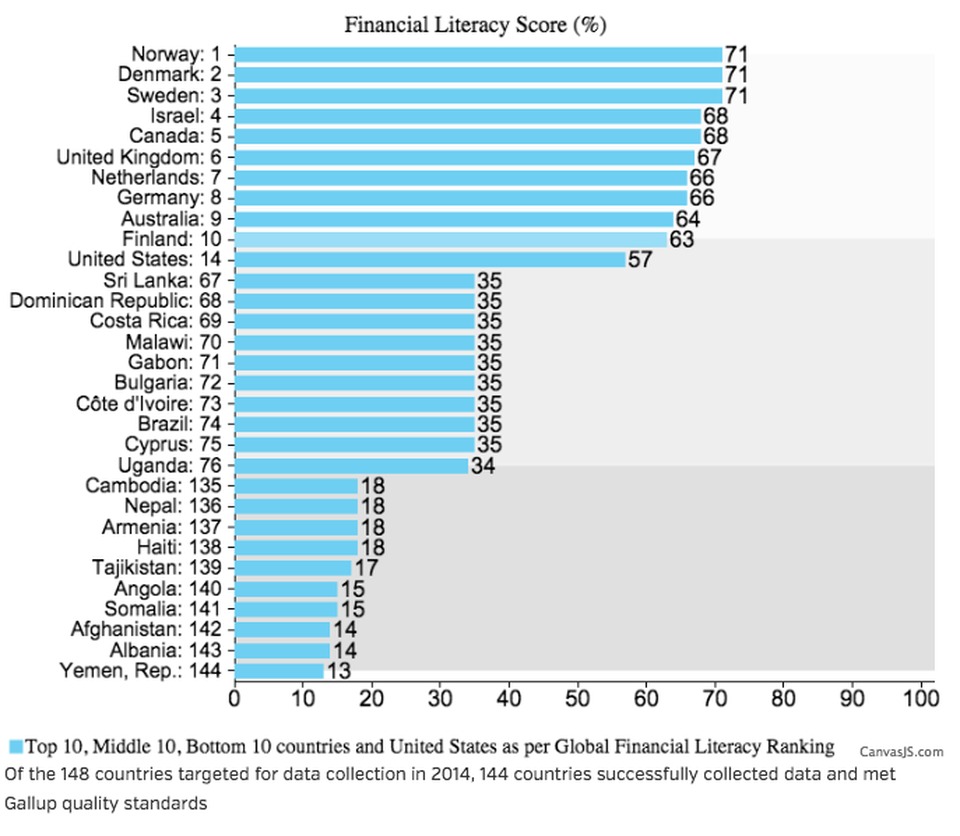

- Your parents didn’t help you. Parents are powerful role models. If you’re lucky, your parents made smart financial decisions and talked to you about the importance of being financially literate. Sadly, there’s a good chance this wasn’t the case, as only a little over ⅓ of the world’s population is financially literate. This rate varies by country, with Yemen coming in at 13%, Norway, Denmark, and Sweden tied at 71%, and the U.S. an unimpressive 57%. And being financially literate isn’t an all or nothing phenomenon. A person can be a smart saver but a poor investor. Maybe your parents smartly eschewed the practice of “keeping up with the Joneses”, but naively relied on a financial advisor to invest half of their retirement money in individual stocks. Note: if you aren’t aware of why this might be a problem, read this. It’s very likely that you picked up some bad financial habits from your parents or didn’t learn much finance from them at all because in many families the subject is taboo.

From Forbes, November 18, 2015

A silver lining

As radiologists, we’re fortunate to earn an above average salary ($427,000 according to the 2020 Medscape survey) so we can make a lot of financial mistakes and still come out okay. We have the ability to get out of debt more quickly compared to physicians in lower-paying specialties. Once we’ve whittled down or eliminated our debt, we have a substantial amount of discretionary income. We can withstand losing a month’s salary from day-trading without having to sacrifice fully funding our retirement accounts.

There are exceptions. At a certain point, you can fritter away so much money on things that don’t bring value to your life that even a radiologist’s salary won’t be enough compensation. Additionally, if your radiology income is on the lower side of the spectrum and you don’t work full-time, or if you are forced to retire from radiology early, you’ll have a smaller cushion of cash to protect you from financial blunders. None of us knows what the future will bring.

You can avoid many of the common financial mistakes that radiologists make by taking steps to becoming financially literate. You can get started by reading one book, and I’ll even suggest a few of my favorites. If you’re already financially literate, pass along the list to a friend who isn’t.

A few good basic financial literacy books:

The White Coat Investor: A Doctor’s Guide to Personal Finance and Investing by James Dahle

Investing for Dummies by Eric Tyson

The Bogelhead’s Guide to Investing by Taylor Larimore, Mel Lindauer, and Michael LeBoeuf

John Clements Money Guide 2016 by John Clements

The Elements of Investing by Burton G. Malkiel and Charles D. Ellis

A couple of my favorite more advanced finance books:

A Random Walk Down Wall Street: The Time-Tested Strategy for Successful Investing by Burton G. Malkiel

Stocks for the Long Run: The Definitive Guide to Financial Market Returns & Long-Term Investment Strategies by Jeremy Siegel

Blogs

I also recommend you subscribe to one or a few physician finance blogs and try to read one post a day. Zen Productivity has already done the work of making a complete list with rankings and social media links.

Oh, and you might consider subscribing to The Reading Room so you don’t miss a single post by yours truly.